There's been a lot of buzz about the Mobile space being used to pay for things, and I found a fascinating company today - TransferTo. TransferTo is a site that enables users to transfer credits from their phones to other phones seamlessly. From their website :

For instance, if an Indian living and working in England wants to transfer credit directly from his mobile phone to his brother's mobile prepaid account back in India, he will go through these 3 simple steps:

| Step 1: | Send the amount and the destination number via SMS to Transfer To™ |

| Step 2: | He will confirm his transaction by replying Y (Yes) or N (No) to cancel it. Transfer To™ system will then process the request and reload his brother's account |

| Step 3: |

Both him and his brother will receive a confirmation SMS when the account is reloaded with the corresponding amount 200 million people around the world are working and living in a country other than their home one. These migrants are remitting back home over $300 billion every year. Out of the 3.1 billion mobile subscribers worldwide, 2 billion are prepaid. They perform 49 billion top-up a yea |

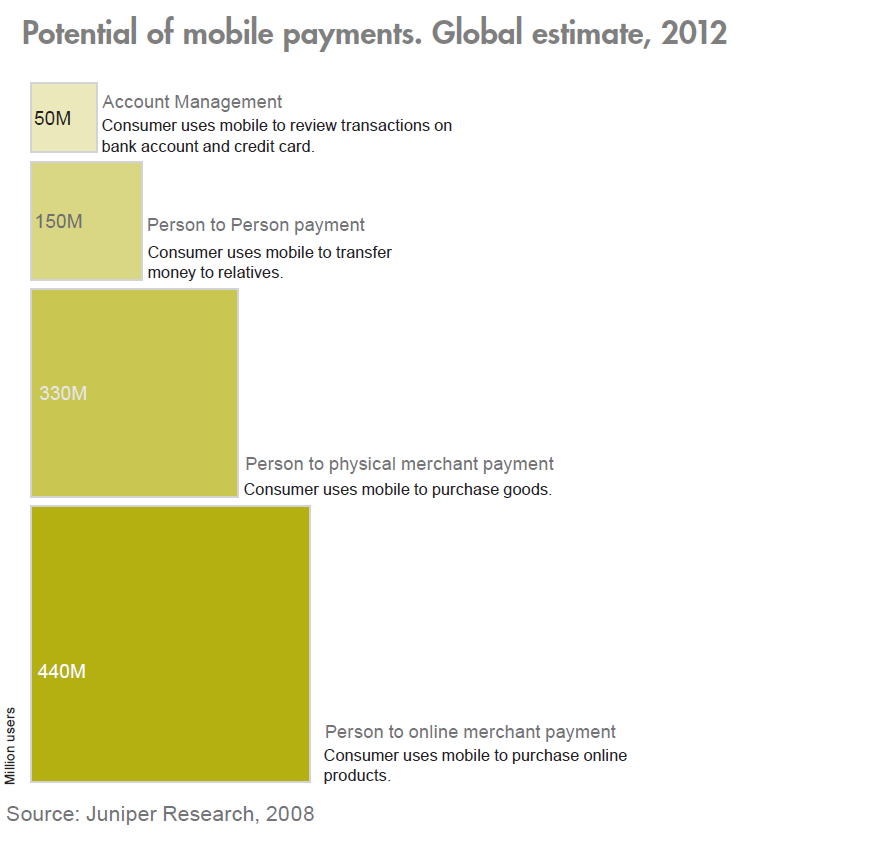

Here's a chart visually depicting the process :

According to Transfer To, over "200 million people around the world are working nad living in a country other than their home one...these migrants are remitting back home over 300 billion every year....[In addition] 2 billion of the 3.1 billion mobile subscribers are prepaid."

A friend of mine was working on a small business that was looking to complete a similar service for immigrants. His service was focused on enabling the Indian man living in London (from the example above) to purchase white goods such as fridges and have them delivered to his brother back home in India. It would be neat if TransferTo could enable this mobile payment mechanism for transferring more than just cell credits...

The advent of mobile banking by the Telefonica group in Latin America has proven to be nothing short of an overwhelming success. It pushed the penetration of financial services in the most rural parts of the continent, by enabling users to make payments and access their accounts via their cell phones. Prior to the advent of mobile banking, these users would march for Kilometers on end to deliver cash payments for their bills, and would have to operate effectively entirely with cash.

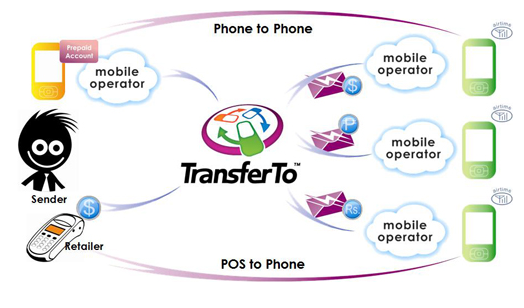

Below is a graphic by the Juniper group on the potential of the mobile payments industry by 2012: