I recently had the opportunity to hear Andy Rachleff give a primer on Venture Capital - and I have to say, Andy is one of the most interesting personalities I've ever encountered. He's a pure contrarian at heart...I don't think he ever answered a question with "I agree" or "yes" - he always said something like "What do you think?", "I don't think X and Y are possible, let's consider Z." This constant questioning ensured that we all walked away from the talk having expanded our line of thinking.

Quick summary of his talk...

Premise I:

Take two types of funds.

Fund I has ten million dollars, and makes ten, one million dollar investments, earning 1 million dollars on each investment over ten years.

Fund II also has ten million dollars, and makes ten one million dollar investments as well. The difference, however, is that eight of the investments brought back zero, and two of the investments brought in 20 million dollars.

Which fund would you rather invest in, and which fund would you rather be a partner in? Andy argues that both investors and partners want to be with Fund II, because the returns are significantly higher. Furthermore, the partner makes significantly more money off of the fund fees in the latter.

Premise II :

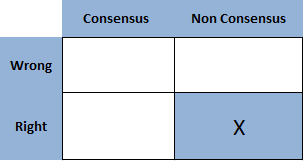

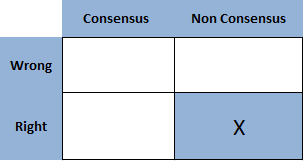

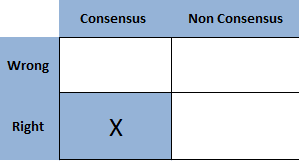

There are two ways to invest, you're either a consensus investor or a non consenus investor. Furthermore, if you're either, you can either be right or wrong.

Andy's thesis (and it's borrowed from one of his favorite investors, whose name I forget) is that you should be a Non-Consensus investor, and right. 95% of Venture Capital returns are brought in by the top 2% of VC firms...and according to Andy, they're the only ones that can be non-conensus investors, and right. Furthermore, they align themselves with Fund II - that is, they swing for the fences with every investment, knowing that 8/10 will fail miserably, but they hope that 2/10 will make 2 0x the investment over 10 years. Andy's argument states that the remaining 98% of VC firms that bring in lower returns, attempt to be non conensus, and are wrong in their investments. This means that out of the 10 investments, maybe 1 makes 10x the return, or maybe none. They swing for the fences and strike out every time.

0x the investment over 10 years. Andy's argument states that the remaining 98% of VC firms that bring in lower returns, attempt to be non conensus, and are wrong in their investments. This means that out of the 10 investments, maybe 1 makes 10x the return, or maybe none. They swing for the fences and strike out every time.

Andy also proposed the thesis that if you're a consensus investor, you're investing in trends that have already been formed, and you're missing most of the upside. He claims that the best VC's find inflection points and invest in them before a market is even created. Take Twitter for example - there was no market in 140 character "micro-blogging" - they created the market opportunity from scratch. Any type of due dilligence on that type of business would have yielded negative information - there was no market to study! HIs point is that they created a new pie that they now own entirely - and it's a VC's job to indentify the cooky entrepreneurs out there that are capable of creating new markets entirely.

Philco's 1.9 Cents....

Although it is true that 98% of VC firms compete for 2% of the overall returns in that asset class, I think that all hope isn't lost for smaller firms. Those that are using Non-Consensus investing and are right, should continue to do so. But those that struggle with that investment thesis, should look at the opposite of what Andy and Benchmark do - they should become Consensus investors and be right. It's true that they might miss some of the initial upside, but if the trend can be their friend. If they know that a certain technology works, and that a new market is growing in it, they can invest in similar businesses that can ride the wave created by the market leader. Think of Facebook - they were the last entrant in the space...there was friendster and myspace YEARS before them, but they knew how to ameliorate the business model despite the market existing already.  Furthermore, I think VC's should focus on VOLUME plays. Making two investments a year is contrary to what modern market investment theory suggests - there's no diversification of risk. VC's should put a little bit of money everywhere, and take on momentum/consensus plays. By being with the consensus, they have a higher likelihood of obtaining returns on their investment (albeit diminished), and by doing a volume play, they're more likely to be in any investment that takes off. As we all know, the history of a VCs success (Ie, stating that they invested in google, or facebook, or twitter, when everyone else looked away), helps that VC capture new dealflow. Entrepreneurs send them more business plans, and they're more likely to be appraoched by future succesful ideas. By playing on volume, they increase the likelihood of both seeing the next Google, and investing in it.

Furthermore, I think VC's should focus on VOLUME plays. Making two investments a year is contrary to what modern market investment theory suggests - there's no diversification of risk. VC's should put a little bit of money everywhere, and take on momentum/consensus plays. By being with the consensus, they have a higher likelihood of obtaining returns on their investment (albeit diminished), and by doing a volume play, they're more likely to be in any investment that takes off. As we all know, the history of a VCs success (Ie, stating that they invested in google, or facebook, or twitter, when everyone else looked away), helps that VC capture new dealflow. Entrepreneurs send them more business plans, and they're more likely to be appraoched by future succesful ideas. By playing on volume, they increase the likelihood of both seeing the next Google, and investing in it.

You’d rather have several people work on the task, and pick the best one.

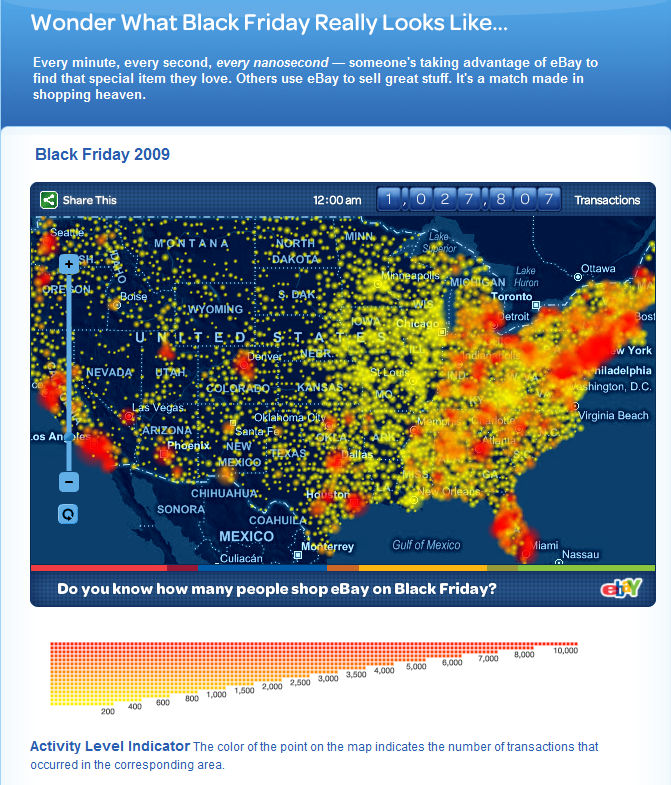

You’d rather have several people work on the task, and pick the best one.